Roth ira early withdrawal penalty calculator

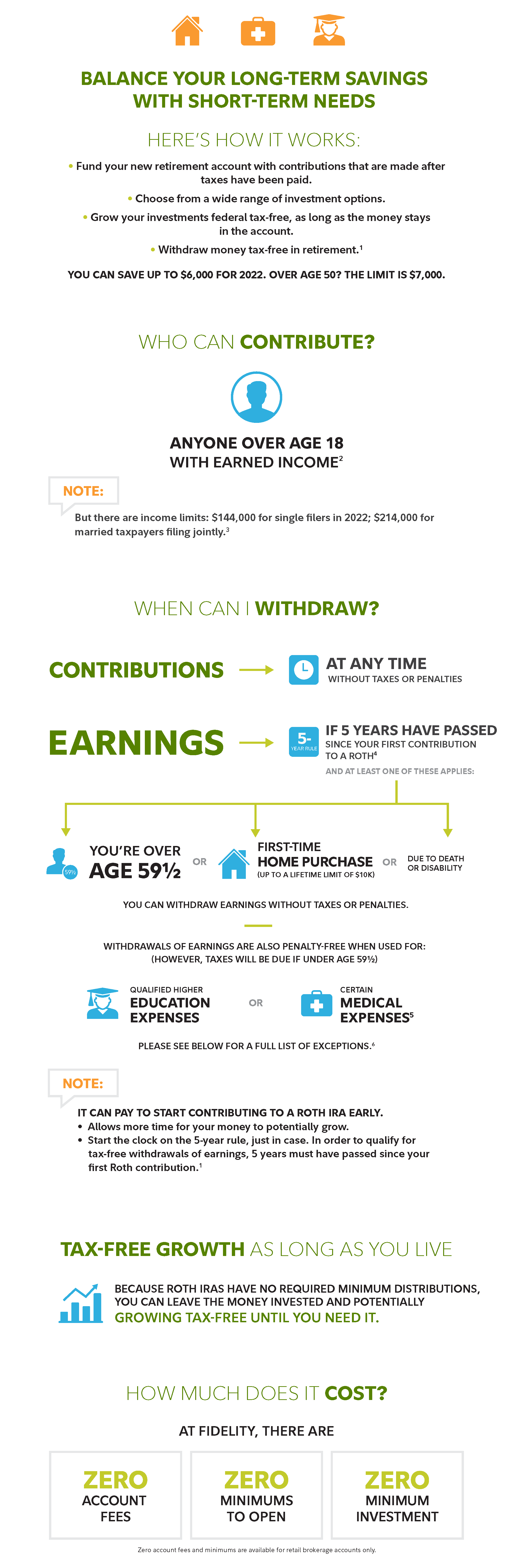

The account can grow without penalty due to the lack of required minimum distributions. If youre that age or older and take withdrawals from a Roth IRA thats less than five years old those would be non-qualified distributions.

Roth Ira Calculator Roth Ira Contribution

How you would pay for it the 38 Medicare surtax and gains on company stock in a 401k.

. You can avoid an early withdrawal penalty if you use the funds to pay unreimbursed medical expenses that are more than 75 of your adjusted gross income AGI. 401K and other retirement plans. In most cases if you withdraw the earnings before you reach age 59 12 you will have to pay a 10 early withdrawal penalty.

How to Withdraw From a Roth IRA Early Penalty-Free. The regular 10 early. It shares certain similarities with a traditional 401k and a Roth IRA although there are important.

Once you reach this age you. Withdrawals must be taken after age 59½. The following COVID information was for 2020 Returns.

As a result of the June 2020 CARES Act retirement account holders affected by the Coronavirus could access up to 100000 of their retirement savings as early withdrawals penalty free with an expanded window for paying the income tax they owed on the amounts they withdrew. In this case you will not be charged the 10 early withdrawal penalty. Before converting a traditional 401k or IRA to a Roth 401k or IRA think about your future.

Birth or adoption expenses New parents can now withdraw up to 5000 from a retirement account to pay for birth andor adoption expenses penalty-free. If youd rather not take the Roth IRA as a lump sum you have options. 401k traditional IRA or Roth IRA.

Note that if you have a Roth 401k you can withdrawal contributions tax-free. A Roth 401k is an employer-sponsored retirement plan thats funded by after-tax dollars. The better option for long-term savings is to transfer the assets to an existing Roth or to open a new Roth IRA.

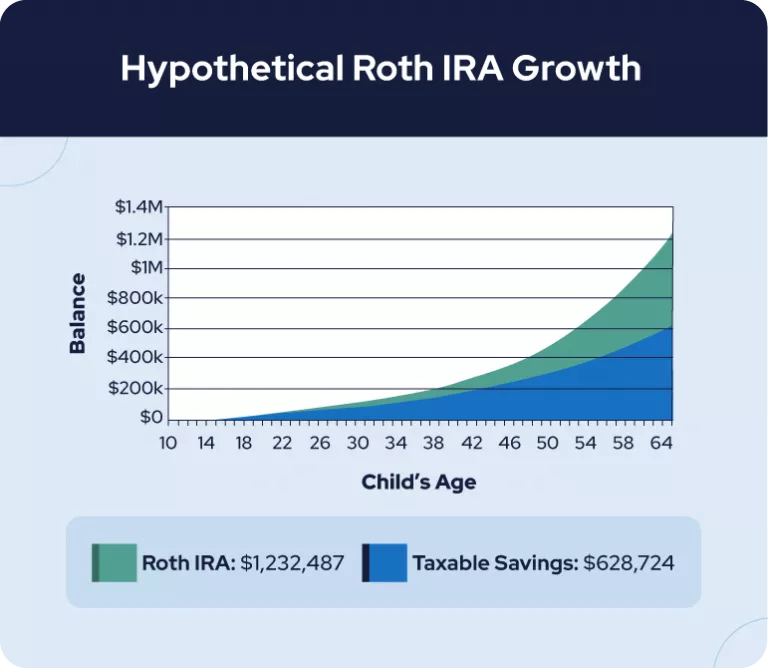

As soon as those 60 days are up the money from the IRA is considered to be cashed out. The magic ages of 59 12 and 70 12 For reasons now lost to legislative history lawmakers set the age for taking penalty-free distributions from your IRA at 59 12. For example if a parent contributes 5000 a year into a Roth IRA for the next 10 years up to 50000 will be available tax- and penalty-free to fund a students higher education.

IRAs also charge a 10 penalty on early withdrawals but they can be. If your Roth IRA account isnt at least five years old or if youre not yet 59½ the earnings portion of any withdrawal may be subject to taxes and a 10 penalty. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus.

401k Withdrawing money from a 401k early comes with a 10 penalty. Tax-free and penalty-free withdrawal on earnings can occur after the age of 59 ½. If you need to withdraw money before youve reached age 59 ½ and met the five-year rule try to limit your withdrawal to the contribution portion because earnings will be taxed.

If you withdraw money before age 59½ you will have to pay income tax and even a 10 penalty. Roth IRA withdrawal and penalty rules vary depending on your age and how long youve had the account and other factors. IRA to avoid the withdrawal penalty.

Its important to follow the Roth IRA rules to avoid owing income taxes and possibly a 10 penalty on your withdrawals. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from. Only Roth IRAs offer tax-free withdrawals.

The five-year count starts with your first contribution to the account. Youd pay taxes on withdrawals of your earnings but not the 10 early withdrawal penalty. The income tax was paid when the money was deposited.

While Roth IRAs are not intended to be a savings account Roth IRAs do allow you to withdraw funds without the 10 early withdrawal penalty. Where you will live in retirement leaving money to others and required minimum distributions RMDs. Its important to note that the five-year rule extends beyond age 595.

You can still take early withdrawals from a traditional IRA but youll be on the hook for income taxes and in most circumstances youll pay the IRS a 10 early withdrawal penalty. Tax-Free Roth IRA Withdrawals. Before making a Roth IRA withdrawal keep in mind the following guidelines to avoid a potential 10 early withdrawal penalty.

You wont have to pay the early-distribution penalty 10 additional tax on your Roth IRA withdrawal if all of these apply. Youll also need to pay tax on the earnings. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

The amounts withdrawn arent more than your your spouses your childs andor your grandchilds qualified higher-education expenses paid during 2021. Consider the costs of a conversion. If you use those early withdrawals for qualified education expenses you wont have to pay the penalty.

Will be taxable in the year received. In general youre allowed to withdraw Roth IRA contributions and earnings without being taxed or penalized. Free inflation-adjusted Roth IRA calculator to estimate growth tax savings total return and balance at retirement with the option to contribute regularly.

Withdrawals must be taken after a five-year holding period. On top of that the IRS will assess a 10 early. If you return the cash to your IRA within 3 years you will not owe the tax payment.

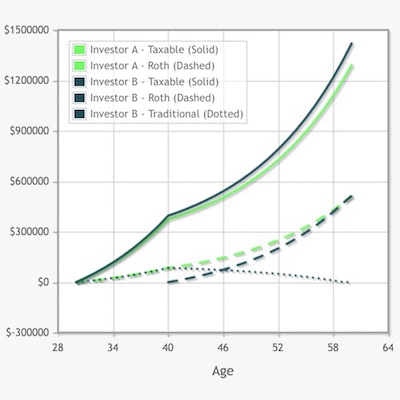

Traditional Ira Vs Roth Ira The Best Choice For Early Retirement

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Pin On Financial Independence App

Roth Ira For Kids Rules And Contributions Shared Economy Tax

Roth Ira Calculator How Much Could My Roth Ira Be Worth

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

How To Access Retirement Funds Early

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Vs Traditional Ira Key Differences Comparison

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

How To Withdraw Money From A Roth Ira With No Penalty And Why You Might Not Want To Nextadvisor With Time

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Save For The Future With A Roth Ira Fidelity

Roth Conversion Ladder The Ultimate Key To Early Retirement

Iras 401 K S Other Retirement Plans Strategies For Taking Your Money Out By Twila Slesnick Phd Enrolled Agent Nolo Retirement Planning Money Book Enrolled Agent

Traditional Roth Iras Withdrawal Rules Penalties H R Block